the working dead

The Essential Survival Guide on How to Protect, Save and Invest for Yourself, Your Family and Your Future

This Book Helps People

- Understand why this country is in a financial crisis how Banks, Companies, Wall Street, Universities & Politicians profit from it

- Analyze where they currently are financially

- Set their goals & dare to dream again

- Learn important financial concepts not being taught in high school, college or graduate school

- Provides proven programs to give them the foundation they need to become financially independent later on in life

The Essential Survival Guide on How to Protect, Save and Invest for Yourself, Your Family and Your Future

This Book Helps People

- Understand why this country is in a financial crisis how Banks, Companies, Wall Street, Universities & Politicians profit from it

- Analyze where they currently are financially

- Set their goals & dare to dream again

- Learn important financial concepts not being taught in high school, college or graduate school

- Provides proven programs to give them the foundation they need to become financially independent later on in life

Free Legacy Building Workshop

- EDUCATING COMMUNITIES ON:

- SAVINGS

- DEBT

- LEGAL

- MONEY

- INCOME

LEARN HOW THE GOVERNMENT

CAN HELP PAY FOR THEIR RETIREMENT

(AND IT’S NOT SOCIAL SECURITY!)

Call today! 212 213-0257

- EDUCATING COMMUNITIES ON:

- SAVINGS

- DEBT

- LEGAL

- MONEY

- INCOME

LEARN HOW THE GOVERNMENT

CAN HELP PAY FOR THEIR RETIREMENT

(AND IT’S NOT SOCIAL SECURITY!)

Call today! 212 213-0257

Learn more about Money

Regardless of Your Education,

Income or Success, Most People:

- Don’t understand how money works

- Earn a low rate of return on their money

- Spend too much of their monthly income

- Are drowning in debt

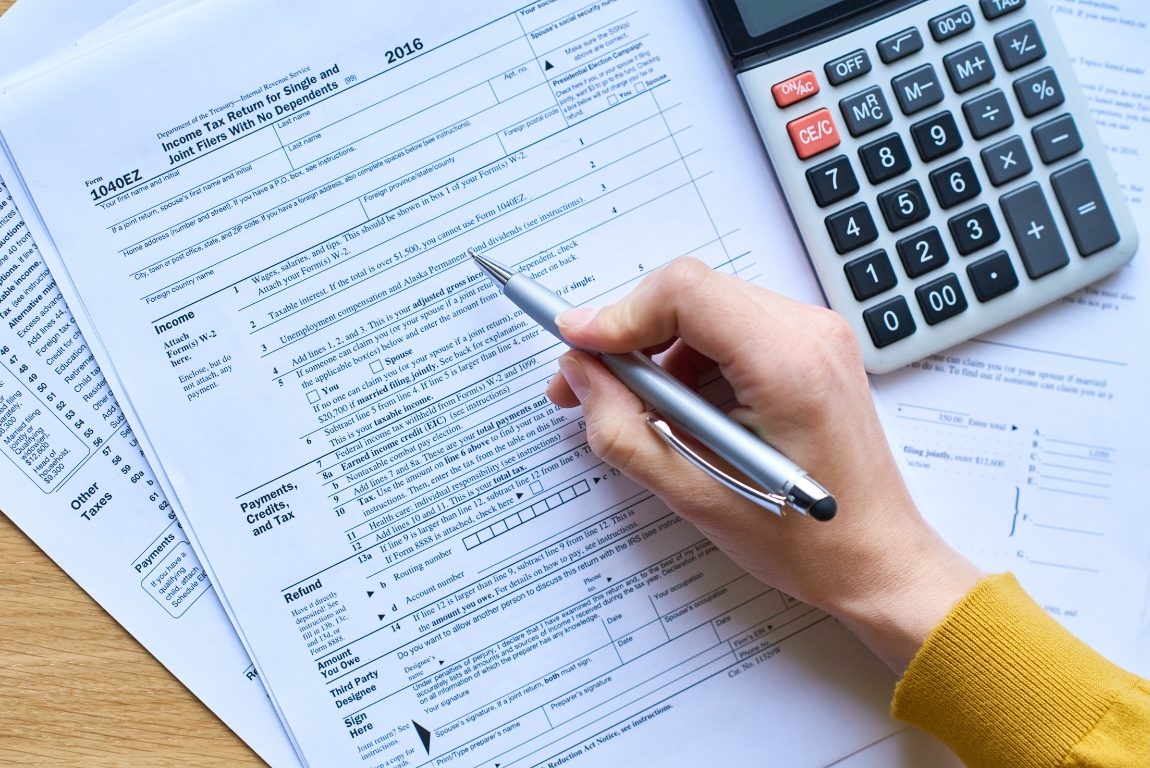

- Pay too much in taxes

- Have little money for emergencies

- Won’t meet their retirement goals

- Won’t be able to fund children’s college education

- Don’t have proper insurance protection

- Don’t have Long Term or Chronic Care protection

- Will have to work long after they should be retired

- Will fail to leave a positive financial legacy

- Will fail to achieve the “Quality of Life” they desire

Regardless of Your Education,

Income or Success, Most People:

- Don’t understand how money works

- Earn a low rate of return on their money

- Spend too much of their monthly income

- Are drowning in debt

- Pay too much in taxes

- Have little money for emergencies

- Won’t meet their retirement goals

- Won’t be able to fund children’s college education

- Don’t have proper insurance protection

- Don’t have Long Term or Chronic Care protection

- Will have to work long after they should be retired

- Will fail to leave a positive financial legacy

- Will fail to achieve the “Quality of Life” they desire

A critical need

ARE YOU PREPARED ?

DEBT GETTING YOU DOWN ?

TAXES ARE GOING UP

“The best financial book since ‘Rich Dad, Poor Dad!”

— Sheng Shueng, Ph.d Economics, M.S. Family Studies

planning for the future

LONG TERM HEALTHCARE

WORKING AFTER RETIREMENT

COLLEGE EDUCATION

readers get all the tools they need properly

money management

RATE OF RETURN

MONTHLY INCOME

FINANCIAL LEGACY

sample chapters

- Why You Should Spend More Time Planning for Your Retirement Than You Spend Watching a Movie

- The Failure of Our Institutions: The Big Lie & The Secret Why

- The Bust of Our 401k, 403b, 457 Retirement Plans

- The Biggest Check You Don’t Want to Get at Retirement

- Tax Now. Tax Later. Tax Never? Never Heard of it?!

- Unlocking the Swiss Army Knife of the Financial Services Industry

debt management

FAILURE TO PAY

TAX BURDEN

TOO MUCH DEBT

a note from the author

“When it comes down to it, in order to have the quality of life we expect and deserve, we all need to be “entrepreneurs” in our own right.

It doesn’t mean that we have to own our own businesses. We just have to have control over our lives — Not just be members of “The Working Dead”, slaving away to make someone else rich.

To avoid that, we have to know how money really works and how to get it to work for us, just like the rich.”

— Lyle Benjamin

“When it comes down to it, in order to have the quality of life we expect and deserve, we all need to be “entrepreneurs” in our own right.

It doesn’t mean that we have to own our own businesses. We just have to have control over our lives — Not just be members of “The Working Dead”, slaving away to make someone else rich.

To avoid that, we have to know how money really works and how to get it to work for us, just like the rich.”

— Lyle Benjamin

understanding money

HOW MONEY WORKS

EMERGENCY

RETIREMENT GOALS

what’s your mission?

do you have a cause you want to support?

PLANNED ACTS & IPOP PROGRAMS ARE BASED ON COLLABORATION BETWEEN PEOPLE, INSTITUTIONS & COUNTRIES AND ARE BUILT ON THE PRINCIPLES OF:

- CIVILITY

- EQUALITY

- EDUCATION

- ACTION

- INCLUSION

- SUSTAINABILITY

QUALITY OF LIFE FOR ALL

fully customizable & scalable programs,

books, courses, workshops, activities, events